Insights

The Next Level of Value Creation in Private Equity

Private equity firms and industrial investors are extending holding periods due to market conditions, leading to the need for Operational Excellence 2.0 for faster value creation and significant results.

Investment and Operating Teams Joining Forces in Private Equity

Private equity firms are enhancing collaboration between investment and operating teams to drive value creation and portfolio growth.

Fund of the Future: Adapting PE for Complex Challenges

Private equity firms are evolving to manage larger, diverse portfolios, global expansions, and shifting LP expectations to maintain competitiveness.

Why PE Firms Are Prioritizing Operational Excellence

Private equity firms are shifting to an operational focus to drive value creation amidst slower dealmaking and heightened competition.

3 Tips for Successfully Scaling Roll-Up Businesses

Learn how to successfully execute a roll-up strategy in M&A by addressing internal challenges, upscaling the seller experience, and prioritizing cultural fit in acquisitions.

Unlocking New Insights for M&A Success with Voice of the Customer (VoC)

This article discusses how Voice of the Customer (VoC) analysis can help private equity investors understand market perception, improve growth strategies, and mitigate risks during M&A transactions.

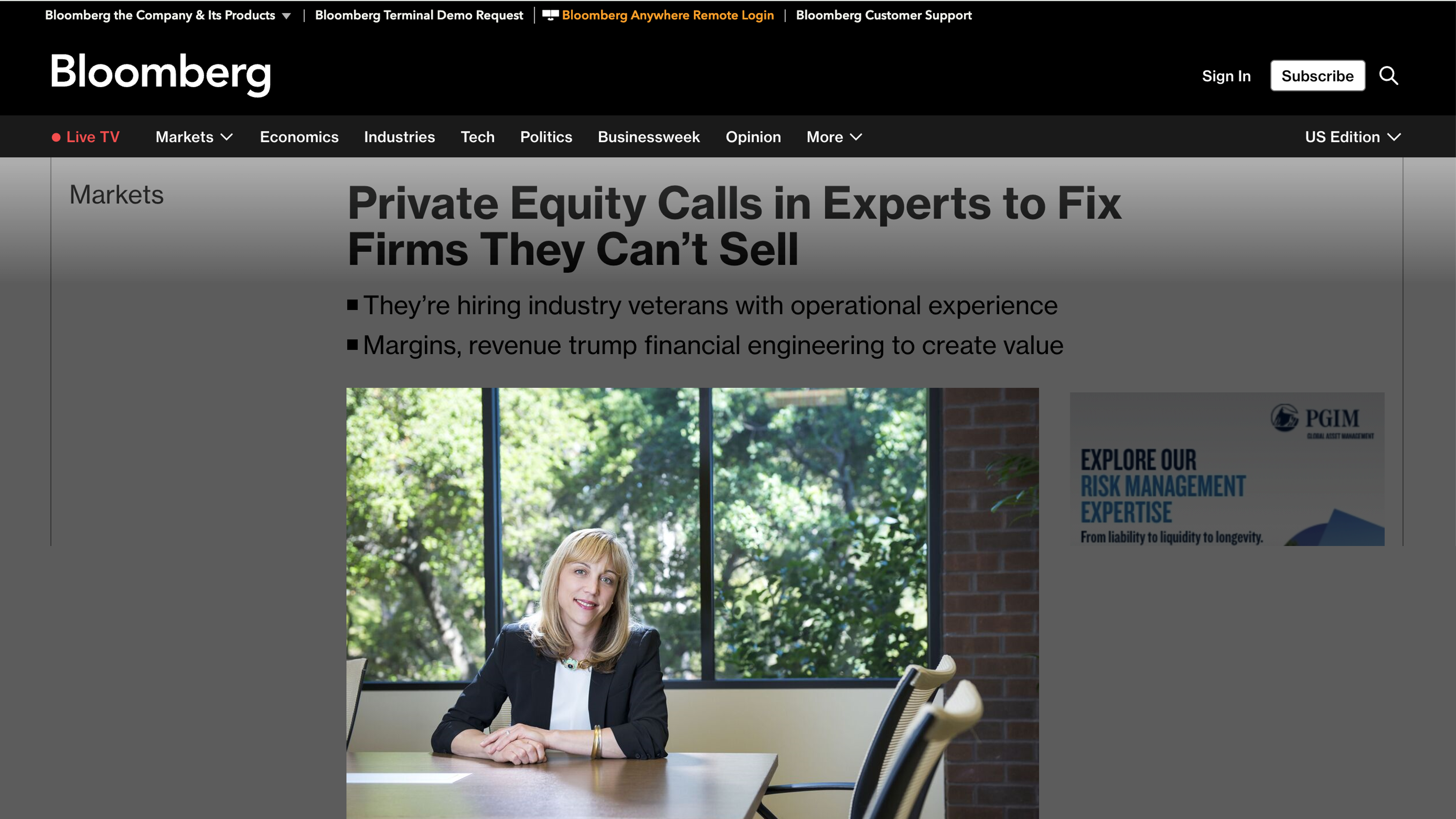

Private Equity Calls in Experts to Fix Firms They Can’t Sell

Private equity firms are now turning to industry veterans with operational experience to improve struggling companies they are unable to sell, prioritizing margins and revenue over financial engineering.

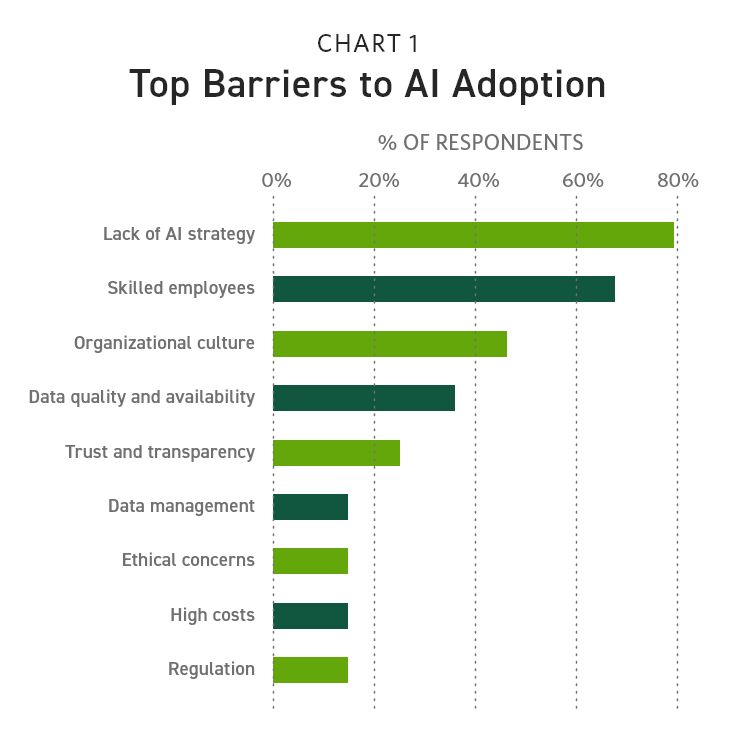

The Strategic Adoption of AI in Private Equity

Private equity firms are leveraging AI and machine learning to optimize fund operations and enhance workflow efficiencies, entering a new era of AI democratization and transformative technology decisions.

Future-Proofing Your Annual Plan: A Guide for Operational Leaders

A comprehensive guide on how operational leaders can effectively prepare for annual planning by analyzing past performance, identifying growth opportunities, and fostering a collaborative culture. Emojis have been used contextually throughout the summary.

How to Succeed at AI Strategy and Implementation: The 5 Questions Every Company Needs Answered

Discover how AI is revolutionizing investment processes through partnerships, AI strategies guided by business value, and the importance of data quality management. 🚀